Marcus Goldman Sachs - Your Money's Good Companion

Thinking about your money and what it can do for you is, for many of us, a pretty big deal, and honestly, a lot of folks are looking for a straightforward way to make their savings work a bit harder. It's about finding a place where your hard-earned cash can grow, where you feel supported in reaching those personal financial hopes and dreams you hold dear. This often means looking for partners who truly understand what it means to put your financial well-being first, offering guidance and tools that feel genuinely helpful, rather than just another service.

So, in some respects, it's not just about picking a bank; it's about choosing a financial friend, someone who's got your back as you sort out your everyday spending and plan for what's next. You might be curious about how certain financial institutions approach this, especially those that come with a name you already recognize, perhaps from a different part of the money world. It's really about seeking out a place that combines a sense of reliability with a fresh, easy-to-use approach to managing your funds, giving you peace of mind.

This brings us, naturally, to a closer look at what Marcus by Goldman Sachs offers, particularly for folks who are keen on making their money grow without a lot of fuss. It’s a part of a much larger, very established financial group, yet it aims to keep things simple and focused on what you, the individual, truly need. We’ll talk about how they help with savings, give you useful tips, and generally make handling your finances feel a little less like a chore and a lot more like a helpful step forward.

- Wisconsin Volleyball Leak

- Wwxx

- T%C3%A3rbanl%C3%A4 Sotwe Twitter

- Paige Butcher

- When Was Fred Astaire Born And Died

Table of Contents

- What Does Marcus Goldman Sachs Do For Your Money?

- How Does Marcus Goldman Sachs Help With Your Financial Hopes?

- Is Marcus Goldman Sachs a Good Choice for Your Savings?

- Exploring the Core Offerings of Marcus Goldman Sachs

- Marcus Goldman Sachs Insights - A Helping Hand?

- The Big Name Behind Marcus Goldman Sachs

- Getting in Touch with Marcus Goldman Sachs - How Easy Is It?

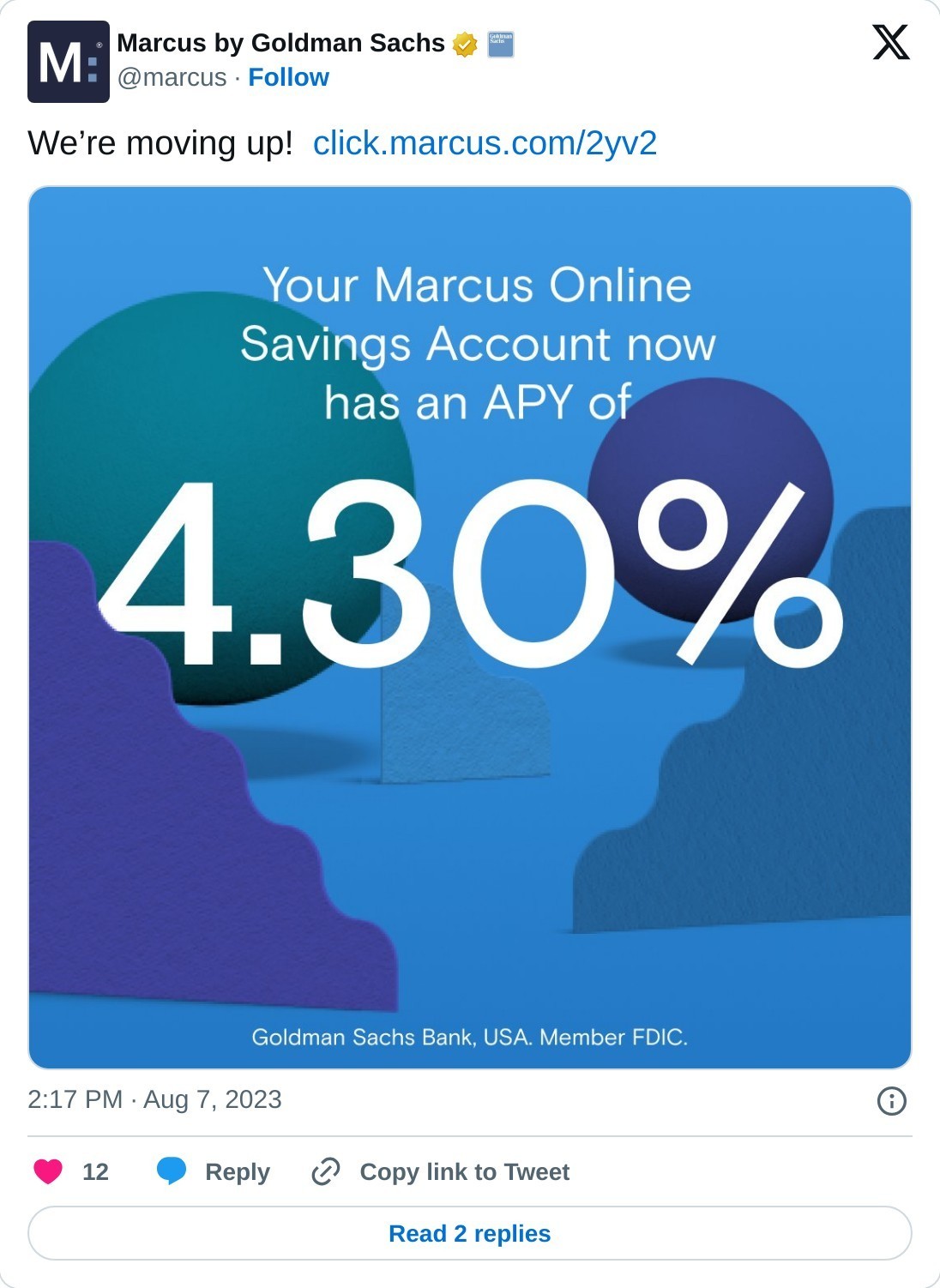

- What Are the Marcus Goldman Sachs Savings Account and CD Rates Like?

What Does Marcus Goldman Sachs Do For Your Money?

When we think about our money, we often picture it doing something important for us, whether that's helping us buy a home, save for a rainy day, or just feel more secure about the future. Marcus by Goldman Sachs, you see, really wants to help people make those money dreams a reality. They are quite focused on making sure their customers have the tools and support needed to get where they want to be, financially speaking. It's a pretty straightforward idea, honestly, aiming to be a helpful hand in your financial story. They put a lot of effort into making sure their offerings align with what real people need to manage their funds effectively, and that's something many of us can appreciate.

They also invite you to find out more about the bigger picture of Goldman Sachs, which is, you know, a pretty big name in the money world. You can learn about the folks who lead the way there, or perhaps look at some thoughts on what's happening in the world's money systems and how big economic shifts might play out. This kind of information, you know, can be really useful for someone who likes to keep an eye on how things are moving generally. It's about getting a sense of the broader financial currents, which, in a way, can help you make sense of your own money choices. So, it's not just about the specific products, but also about the larger intelligence they share.

- T%C3%A3rbanl%C3%A4 Sexs Sotwe

- The Fanbus Tv Cast

- Ripped Digital Chloe Kreams

- Funpomcom

- If%C3%A5%C3%BFa T%C3%A3rk

How Does Marcus Goldman Sachs Help With Your Financial Hopes?

One of the ways Marcus by Goldman Sachs really tries to help people with their financial hopes is through a neat feature called Marcus Insights. This is a special tool, available right there on their mobile app, which is super convenient for most people these days. With this tool, you can, in a way, make your money work better for you, and it does it in a pretty hands-off manner. Imagine having something that just helps your funds do their best, without you having to constantly fuss over every little detail. That's sort of what they are going for with this particular feature, making things smoother for your finances.

It's about getting your money to do more, perhaps by finding ways to put it to better use or to organize it in a smarter fashion. For someone who is looking for an online bank, maybe with a savings account that gives you a good return, this kind of helpful feature can be a real bonus. You see, it takes some of the thinking out of it, letting the app do some of the heavy lifting. This means you might spend less time stressing about your cash and more time seeing it grow, which is, honestly, a pretty nice feeling for anyone trying to build up their savings. So, it's a tool that aims to simplify things for you.

Is Marcus Goldman Sachs a Good Choice for Your Savings?

When it comes to putting your money away, particularly for something important like an emergency fund or a specific goal, many people wonder if an online option is the way to go. Vault’s viewpoint, for instance, suggests that Marcus by Goldman Sachs savings accounts are a really solid pick if you're trying to put money aside for a particular reason. They see these accounts as a helpful spot for your cash to sit, perhaps for something you're planning for, like a big purchase, or just to have a safety net for unexpected situations. It’s pretty clear they think it's a sensible way to keep your money safe and growing.

These accounts, you know, are set up to allow your money to do its thing, which is to say, they offer a way for your savings to increase over time. It's about having a dedicated spot for those funds that you don't need right away, letting them build up steadily. So, if you're the kind of person who likes to have a clear purpose for your savings, whether it's a future vacation or just peace of mind, then this kind of account could be a good fit. It offers a practical path to making sure your money is working for you, rather than just sitting there doing nothing. That, in fact, is what many people are looking for in a savings option.

Exploring the Core Offerings of Marcus Goldman Sachs

Marcus by Goldman Sachs is, in essence, a brand that comes from Goldman Sachs Bank USA and Goldman Sachs & Co. LLC. These are, you might say, parts of the larger Goldman Sachs Group, Inc. So, when you hear "Marcus," you're really talking about a consumer-focused arm of a very well-known financial institution. It’s an online bank, which means it operates without traditional physical branches, making it pretty accessible for many folks these days. Being part of one of the biggest names in financial services, it naturally carries a certain weight and history with it, which can be reassuring for people thinking about where to put their money. It's like having the backing of a very established player in the money world, just in a more modern, online form.

Marcus by Goldman Sachs, you know, tends to focus on a couple of specific things rather than trying to do everything under the sun. This specialization means they really put their efforts into those particular areas, aiming to do them quite well. For someone looking into their options, knowing that a company has a clear focus can be a good thing, as it often means they've refined what they offer. A full review for 2025, for instance, would likely go into detail about these focused services, giving you a complete picture of what to expect. They are, in a way, streamlining their offerings to provide clarity and strength in specific financial products, which is pretty sensible.

They are, as we've talked about, quite dedicated to helping people reach their money goals. This commitment runs through everything they do, from the way they structure their accounts to the advice they might share. It’s about being a supportive presence for individuals as they work towards what they want to achieve financially. You can, for example, find out all the different ways you can get in touch with Marcus by Goldman Sachs, which speaks to their desire to be available to their customers. Having easy ways to connect with your bank is, honestly, a pretty big deal for most people, making the whole experience feel more approachable and less distant.

Marcus Goldman Sachs Insights - A Helping Hand?

Making good financial decisions, as a matter of fact, often starts with having information you can trust, and getting it right when you need it most. Marcus is there to offer financial know-how and resources for all sorts of life’s moments, whether they are big, like buying a home, or small, like just trying to save a bit more each month. They also bring in economic thoughts and smart ideas from across the wider Goldman Sachs family, which can be pretty useful. This means you're getting perspectives from a place that spends a lot of time thinking about the bigger money picture, which is quite valuable.

They also provide frequently asked questions about Marcus by Goldman Sachs, which is a really helpful way to get quick answers to common concerns. This shows they are trying to anticipate what people might wonder about and provide clear explanations. Marcus, in some respects, sees itself as being on a kind of mission: to help you make the very best of your money potential. They do this by offering a collection of consumer products, and all of these are backed by a really long history, over 150 years, of Goldman Sachs’ special knowledge. So, you're getting the benefit of a lot of accumulated wisdom, which is pretty reassuring.

The Big Name Behind Marcus Goldman Sachs

When you hear the name "Goldman Sachs," it usually brings to mind a very long-standing and, frankly, very well-known presence in the financial world. Marcus, as we’ve discussed, is the part of this big company that focuses on individual people and their money needs. It’s like a specialized branch, if you will, that aims to make the kind of financial expertise usually associated with large institutions available to everyday savers. This connection to such a prominent name can give a lot of people a feeling of confidence, knowing there’s a substantial history and a lot of experience behind the services they are using. It's a bit like knowing your money is in the hands of people who have been doing this for a very, very long time.

The fact that Marcus is an online bank, yet still carries the Goldman Sachs name, means it blends modern convenience with established trust. You get the ease of managing your money from wherever you are, without having to visit a physical place, while still feeling secure about the institution handling your funds. This combination is pretty appealing for many folks today who are used to doing things digitally but still want that sense of reliability. It’s about bringing a traditional powerhouse into the current way people live and manage their finances, offering a fresh take on banking that still feels grounded in a long history of financial work.

They have, in a way, channeled their extensive knowledge into just a few key areas that matter most to individual consumers. This focused approach is a deliberate choice, allowing them to put their energy into providing specific, high-quality products. It means that when you consider Marcus, you're looking at services that have been developed with a deep understanding of how money works and how people interact with it. So, while the name "Goldman Sachs" might typically be associated with big business and global markets, Marcus represents their commitment to serving a broader audience, bringing that same level of expertise to your personal financial life, which is pretty neat.

Getting in Touch with Marcus Goldman Sachs - How Easy Is It?

For anyone dealing with their money, knowing how to get help or ask a question is, honestly, a pretty big deal. It’s important to feel like you can easily connect with your bank when you need to, whether it's for a quick query or something more involved. The information available about Marcus by Goldman Sachs makes it clear that they want to make this process as straightforward as possible. They provide ways for you to find out all the different avenues you can use to reach out to them, which suggests they value being accessible to their customers. This is a crucial part of building trust, knowing that a real person or a helpful resource is just a few steps away.

Being able to contact your financial provider without a lot of hassle can really make a difference in your overall experience. It means if you have a question about your savings account, or perhaps something about the Marcus Goldman Sachs insights tool, you won't be left wondering where to turn. This focus on clear communication channels is, in some respects, a sign of their dedication to customer support. They want to make sure that when you need assistance, it's not a frustrating search, but rather a simple process to get the help you are looking for. So, it's about making sure the lines of communication are open and easy to use for everyone.

What Are the Marcus Goldman Sachs Savings Account and CD Rates Like?

When it comes to putting your money into a savings account or a certificate of deposit, the rates you can get are, honestly, a very important factor for many people. Marcus by Goldman Sachs offers both online savings accounts and CDs, and they aim to provide rates that are, well, quite good when compared to what else is out there. These are often referred to as "high yield" rates, meaning your money has a better chance of growing more quickly than it might in a standard account. This is a pretty big draw for folks who are serious about making their savings work harder for them, which is a common goal for many of us.

Learning more about the CD rates from Marcus by Goldman Sachs, for instance, can help you figure out if these products fit with your own money plans. CDs, you know, typically involve putting your money away for a set period, and in return, you often get a higher interest rate than with a regular savings account. So, if you have money you won't need for a while, a CD from Marcus by Goldman Sachs could be a sensible option to consider. It’s about finding the right home for your funds that matches your timeline and your desire for growth, and they seem to offer options that are pretty competitive in the market, which is always a plus for savers.

This article has explored Marcus by Goldman Sachs, highlighting its commitment to helping individuals achieve their financial aspirations. We've looked at how they offer tools like Marcus Insights to help optimize personal funds and how their savings accounts and certificates of deposit are seen as good choices for specific saving purposes. The piece also touched on Marcus being an online bank, a part of the larger Goldman Sachs Group, and how its specialization aims to serve consumers directly. Finally, we considered the accessibility of their customer contact options and the competitive nature of their savings and CD rates.

Marcus by Goldman Sachs on Tumblr

2 Marcus by Goldman Sachs Reviews and Complaints @ Pissed Consumer

Marcus by Goldman Sachs High-Yield Savings Accounts Review : r